Empowering Youth Through Tax Literacy

Youth Business Alliance in collaboration with Haven Neighborhood Services is launching a pilot program to provide low-and moderate-income (LMI) high school students in South Los Angeles with essential tax literacy and practical tax preparation skills.

What is the primary issue area that your application will impact?

Youth economic advancement

In what stage of innovation is this project, program, or initiative?

Pilot or new project, program, or initiative (testing or implementing a new idea)

What is your understanding of the issue that you are seeking to address?

There is a significant gap in early-age programs in promoting tax literacy and hands-on tax filing experience. This gap leaves students ill-prepared for real-world financial obligations. A 2023 study by the Tax Foundation found that over 61% of tax filers lacked knowledge of basic income tax concepts, highlighting a deficiency in financial education within our institutions. Additionally, research by Annuity in 2023 revealed that 75% of American teens are not confident in their personal finance knowledge. YBA and HNS have developed an innovative pilot program focused on providing tax literacy and hands-on tax prep. Teaching practical tax literacy skills early empowers youth to make informed financial decisions, fostering financial responsibility and preparing them for real-world financial obligations. Through this collaboration, students will gain the skills needed to provide free tax preparation services to the local community, reinforcing their learning and giving back to society.

Describe the project, program, or initiative this grant will support to address the issue.

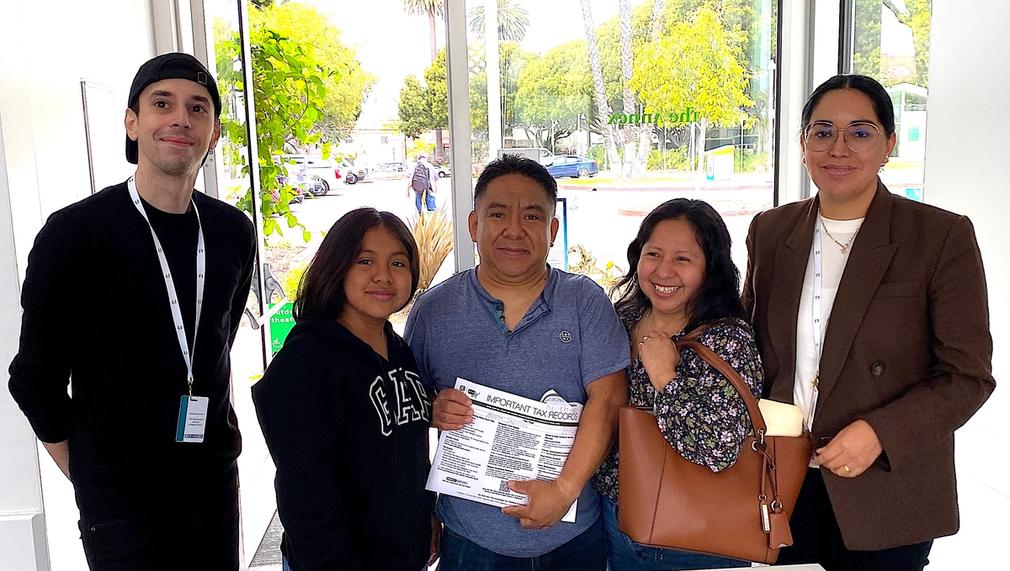

YBA and HNS are committed to supporting 100% LMI communities, particularly those disproportionately affected by barriers to economic mobility. With a shared interest in financial capability, YBA predominantly serves BIPOC students focusing on upskilling and workforce exposure. YBA will partner with high schools in South LA to introduce a new tax literacy and preparation unit. YBA’s Program Director has experience in tax filing and VITA site management and will adapt a high school-level tax literacy curriculum. This program will enable students to develop tax literacy and soft skills, preparing them to volunteer at HNS-led IRS Volunteer Income Tax Assistance (VITA) sites. The curriculum will cover essential topics from basic tax filing eligibility and benefits to complex tax topics such as capital gains, tax credits, etc. Students will use tax software to prepare Federal/State income tax returns. After thorough training, students will gain hands-on experience by filing taxes at HNS's VITA sites under the supervision of certified tax preparers. HNS operates a reputable VITA program across multiple South LA locations, providing free basic tax return preparation for LMI taxpayers. During tax season, HNS will facilitate this initiative, offering students invaluable hands-on experience. Each student will complete 20 hours of VITA services. This involvement will result in over 300 tax filings by students in our program, significantly benefiting both the students and the community.

Describe how Los Angeles County will be different if your work is successful.

According to IRS data on VITA programs, the primary barrier to expansion is the lack of volunteers. Through this pilot program, YBA & HNS expect 30 students to complete and receive certification for tax preparation and literacy before the start of tax season in February 2025. The transformation begins in the student’s classrooms and extends to their families and community members. By understanding taxes, students can enhance their budgeting abilities, plan for the future, and avoid common financial pitfalls. Additionally, tax literacy is a valuable skill that can significantly boost career opportunities and strengthen resumes, showcasing a critical competency to potential employers. The long-term goals are to train more students around Los Angeles and partner with a local community college to provide students with college credit. By addressing the shortage of VITA volunteers, we will contribute to socio-economic development, channeling funds back into the local community.

What evidence do you have that this project, program, or initiative is or will be successful, and how will you define and measure success?

To determine the success of the tax literacy and hands-on experience program for students, YBA and Haven will collaborate to document the number of students who complete the training and the percentage of students who successfully pass the certification test. We will conduct pre and post-program surveys to assess students' soft skills, knowledge of tax law, and their confidence in tax preparation. In addition, our collaborators HNS will collect quantitative and qualitative data on the number of tax returns prepared and submitted by students, the accuracy of these returns, and the total number of LMI taxpayers assisted and using a Likert scale (e.g., from 1 to 5) to gauge customer satisfaction with the student's services. A successful outcome will ensure that tax fillings are completed accurately and efficiently by our students. The long-term expansion includes scaling to more local high schools, empowering students with tax literacy, and returning funds to the local communities.

Describe the role of collaborating organizations on this project.

Haven Neighborhood Services (HNS) will play a crucial role in this pilot program, offering expertise and support to YBA. HNS will guide the development of a tax literacy curriculum and provide hands-on tax filing experience for youth, leveraging their extensive experience in training volunteers. They will also assist in creating evaluation tools to measure the program's impact, ensuring a comprehensive assessment strategy. Furthermore, HNS will provide space at their VITA center for supervised, practical experience, ensuring accurate tax filings and effective learning. HNS will also lead efforts to obtain necessary documents, supporting the program's overall success.

Approximately how many people will be impacted by this project, program, or initiative?

Direct Impact: 30.0

Indirect Impact: 300.0